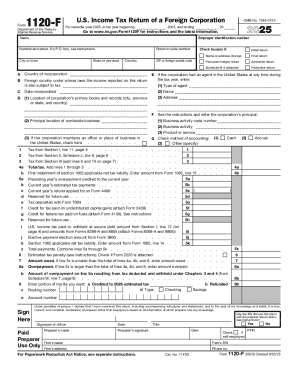

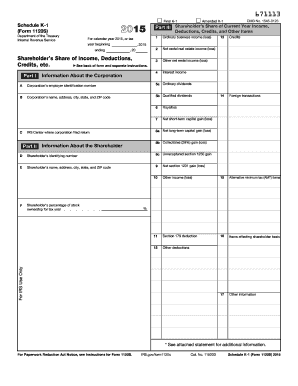

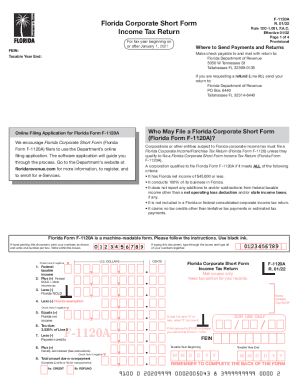

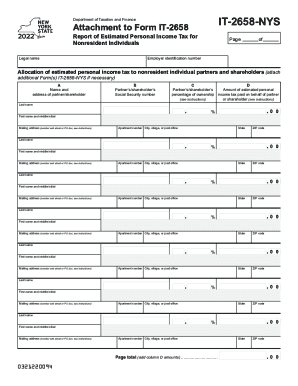

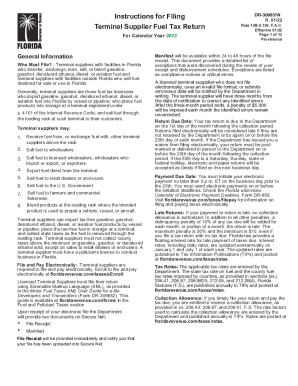

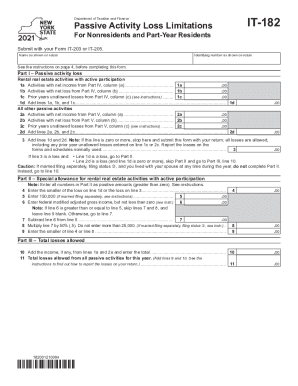

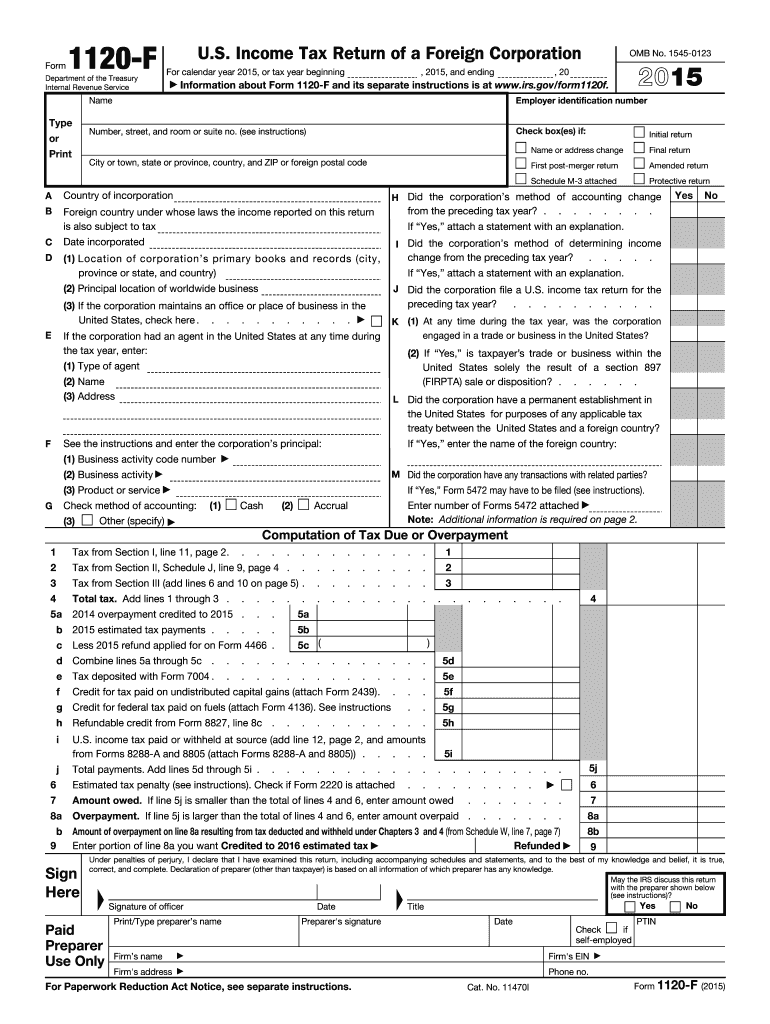

IRS 1120-F 2015 free printable template

Instructions and Help about IRS 1120-F

How to edit IRS 1120-F

How to fill out IRS 1120-F

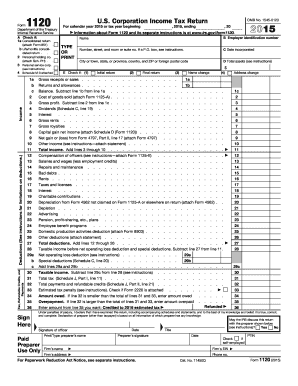

About IRS 1120-F 2015 previous version

What is IRS 1120-F?

Who needs the form?

Components of the form

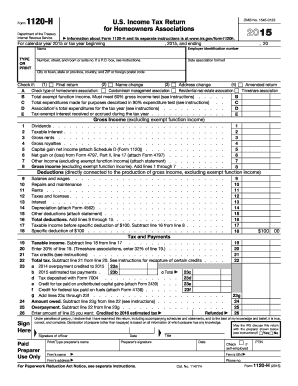

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

What payments and purchases are reported?

What information do you need when you file the form?

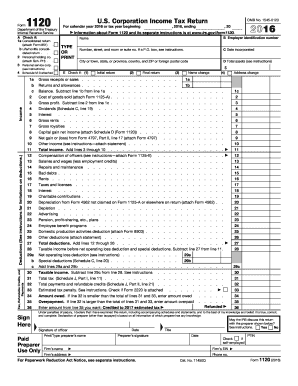

Where do I send the form?

FAQ about IRS 1120-F

How can I edit [SKS] from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your [SKS] into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I sign the [SKS] electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your [SKS] in seconds.

How do I fill out [SKS] using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign [SKS] and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is IRS 1120-F?

IRS 1120-F is the U.S. Income Tax Return of a Foreign Corporation, used by foreign corporations to report their income, gains, losses, deductions, and credits effectively connected with a trade or business in the United States.

Who is required to file IRS 1120-F?

Foreign corporations that engage in a trade or business in the United States and have income that is effectively connected with that business are required to file IRS 1120-F.

How to fill out IRS 1120-F?

To fill out IRS 1120-F, foreign corporations must provide their identifying information, report their effectively connected income, deductions, tax credits, and calculate their tax liability according to IRS guidelines and instructions specific to the form.

What is the purpose of IRS 1120-F?

The purpose of IRS 1120-F is to provide the IRS with a comprehensive report of a foreign corporation's income and taxes owed within the United States for proper tax assessment and compliance.

What information must be reported on IRS 1120-F?

IRS 1120-F requires reporting of various types of income, including effectively connected income, gross income, deductions, credits, and pertinent details regarding the corporation's activities in the U.S.